Preparation of Fund Flow Statement and it’s analysis

Preparation of Fund Flow Statement and Its Analysis

Overview: A Fund Flow Statement provides a detailed analysis of changes in the financial position of a business between two balance sheet dates. It highlights the movement of funds (working capital) within the business, showing sources and applications of funds.

Key Concepts:

- Fund: Generally refers to working capital, defined as the excess of current assets over current liabilities.

- Flow of Funds: Movement of funds that results in a change in working capital, involving transactions between current and non-current accounts.

Identification of Flow of Funds

Flow of Funds Occurs When:

- Current and Non-Current Accounts are Involved: Transactions that involve one current account and one non-current account.

- Current Accounts Only: No flow if only current accounts are involved.

- Non-Current Accounts Only: No flow if only non-current accounts are involved.

Sources of Funds

- Funds Generated from Operations: Difference between revenue from sales and payment of costs.

- External Sources: Issuance of shares, long-term loans, sale of non-current assets.

Steps for Preparing a Fund Flow Statement

- Determine Change in Working Capital: Calculate the net increase or decrease in working capital between two periods.

- Adjust Net Income: Adjust net income for non-cash items (like depreciation).

- Analyze Non-Current Accounts: Establish increases or decreases in non-current assets and liabilities to identify sources and uses of funds.

- Verify Totals: Ensure total sources of funds match the total uses of funds, reconciling with the change in working capital.

General Rules for Preparing Fund Flow Statement

- Increase in Current Asset: Increase in working capital.

- Decrease in Current Asset: Decrease in working capital.

- Increase in Current Liability: Decrease in working capital.

- Decrease in Current Liability: Increase in working capital.

- Simultaneous Changes: Increase in current assets and liabilities, or decrease in both, does not affect working capital.

- Changes in Non-Current Assets/Liabilities: Affect working capital.

Format of Fund Flow Statement

Statement Form:

Sources of Funds:

- Funds from Operations

- Issuance of Share Capital

- Long-term Loans

- Sale of Non-Current Assets

Applications of Funds:

- Purchase of Non-Current Assets

- Repayment of Loans

- Payment of Dividends

- Increase in Working Capital

Example

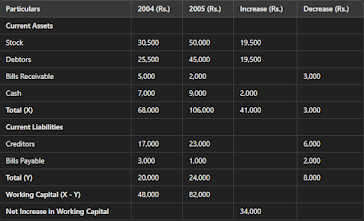

Balance Sheet Data (Simplified):

Sources of Funds:

- Funds from Operations: 42,000−35,000=7,00042,000 - 35,000 = 7,00042,000−35,000=7,000 (based on Profit and Loss account).

- Increase in Working Capital: 82,000−48,000=34,00082,000 - 48,000 = 34,00082,000−48,000=34,000.

Analysis of Fund Flow Statement

- Assess Financial Health: Helps in understanding the financial stability by analyzing sources and uses of funds.

- Decision Making: Aids management in making informed financing and investment decisions.

- Identifying Trends: Reveals trends in working capital changes, which can indicate efficiency in managing current assets and liabilities.

- Investment and Financing: Provides insight into how well the company is financing its operations and investments.

Important Points:

- Unlike cash flow statements, fund flow statements are prepared on an accrual basis.

- It is crucial for assessing long-term financial strategies and ensuring that short-term liquidity is not compromised by long-term investments.

This detailed explanation and example help in understanding the preparation and analysis of the fund flow statement, emphasizing its importance in financial management.